The value of one Bitcoin reached close to $19,000 USD during 2017, piquing consumer interest in its underlying Blockchain technology. Photo courtesy/Wikimedia Commons

2017 marked an outstanding year for digital titans Amazon and Netflix, whose stock was up 33 percent and 58 percent respectively at the end of December.

However, the best investment of 2017 wasn’t in any obvious corporation with stock traded daily on the exchanges. The winner was Bitcoin, a digital cryptocurrency owned by everyone and no one at all.

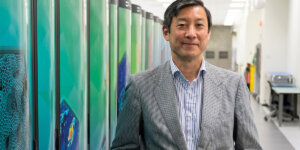

The frenzy over Bitcoin has prompted several higher-ed institutions to offer courses on the “blockchain” technology behind it. This spring, Nitin Kale, an associate professor in USC Viterbi’s Information Technology Program (ITP), teaches ITP499 – Blockchain, the university’s second offering on the subject. Kale instructed the first USC course on the peer-to-peer technology in fall 2017.

Kale explained that classes are so popular that, due to limited space, students are turned away in droves.

“2017 was the year of Bitcoin,” Kale said. “The students are very, very excited.”

During 2017, the value of one Bitcoin crested at around $19,000 USD – a figure that created overnight millionaires and elevated the cryptocurrency to investment, asset-class fortunes. Bitcoin’s profitable value has many people, from curious neophytes to established investors, seeking to understand how blockchain technology works.

A Mysterious, Unhackable Technology

Bitcoin’s origin story is peculiar. The technology was originally described in a 2008 white paper by an individual named Satoshi Nakamoto, a pseudonym. Kale states that nobody knows Nakamoto’s true identity, gender, nationality, whereabouts or even whether he/she is one person or a group of people. Nakamoto, who many believe is identified through his cryptographic name or “seed” in the ledger’s history, dropped off the platform mysteriously in 2010.

What’s more, Bitcoin is a decentralized, open-source software platform that is free and available to all on the Internet. Anonymous participants are distributed across the globe in “nodes,” making it virtually impossible to hack.

“Being decentralized takes the system away from a central location, or a central point of failure or attack and makes it really thin and distributed,” Kale said. “It’s everywhere, so in order to attack you have to do so in many different places.

Bitcoin has special participants called “miners” who opt in voluntarily and use computing power to solve a math puzzle called the “proof-of-work.” Excessive computing resources are hurled at the puzzle in order to solve it, an approach Kale calls “brute force.”

The first miner to verify the block, or ledger of transaction data, and accurately solve the “proof of work” is rewarded 12.5 newly minted Bitcoins and all transaction fees within that ledger. Then, a new block of transactions begins – hence, the term “blockchain.”

The Disruptor

Bitcoin users also benefit when making everyday purchases because they don’t pay high commissions to dominant third parties. Kale explains that Bitcoin users can send payments globally with much lower transaction fees compared to an intermediary like Western Union or PayPal. Bitcoin’s public ledger of transactions also discourages fraud.

“In this way, the technology can be disruptive because it may change how people do business, the first possibility being the financial banking industry itself,” Kale said. “It creates trust in a trustless system.”

But if Bitcoin sounds too good to be true, then there’s the rub.

Bitcoin’s worth is highly volatile; In January 2018, the value of one coin dropped to less than $10,000 USD, losing between 40 and 50 percent of its peak value.

The sharp decline is likely due to the South Korean government’s threat to regulate the cryptocurrency, Kale states. Even hints at federal regulation create panic in Bitcoin’s users, spurring them to sell their coins.

Bitcoin mining has become more and more difficult, which means that miners have to expend a tremendous amount of computing resources to mine the next coins -Nitin Kale

Because Bitcoin is open-source, the software code is freely available to the public and can be tweaked slightly, then reintroduced as a different cryptocurrency – a practice that has spawned a rash of other blockchain cryptocurrencies, most of which have minimal to no value. The second-most valuable cryptocurrency is Ether, available from an open-source blockchain platform called Ethereum. At the time of writing, one ETH (the name for an Ether coin) was worth approximately $957 USD.

Another drawback: the excessive amount of computing power required to fuel Bitcoin’s technology is cost-prohibitive. Mining is increasingly concentrated in countries like China where electricity is cheaper.

“Bitcoin mining has become more and more difficult, which means that miners have to expend a tremendous amount of computing resources to mine the next coins,” Kale said.

Since Bitcoin is limited-supply, a day will come with no more new coins on the horizon. So far, 17 million of the available 21 million coins have already been mined.

Even though the end seems nigh, Kale says that miners can still reap transaction fees by solving the math puzzle in each new block of Bitcoin transactions. For that reason, Bitcoin could live on indefinitely, explains Kale.

Kale adds that blockchain technology itself could impact the non-financial sector as well, creating disruption in government, banking, contracting and identity management, all through its fraud-proof mechanism.

However, in 2018, time will tell as the blockchain revolution has only just begun with Bitcoin.

Published on February 7th, 2018

Last updated on May 16th, 2024