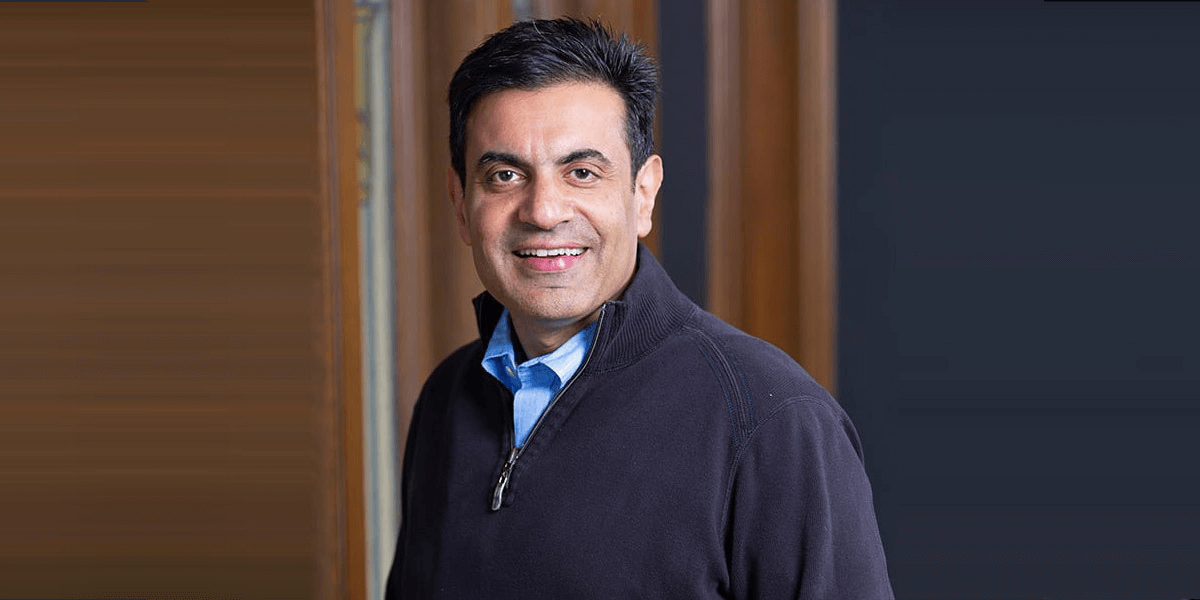

Preetish Nijhawan went from startup founder to startup investor, and he’s using his experience and knowledge to lead new entrepreneurs towards their own success. (Image Courtesy of Cervin Ventures)

From the start of his career, USC Viterbi alumnus Preetish Nijhawan, M.S. CE ’90, has had a passion for entrepreneurship and disruptive innovation. A former startup founder himself, Nijhawan’s current pursuit, Cervin Ventures, focuses on supporting early-stage tech startups in the enterprise software space — software for companies and organizations.

Nijhawan cofounded Cervin Ventures in 2011 and currently works as a managing partner there. The Palo Alto-based firm works to support founders by providing them with funding, resources, knowledge, and experience at a very early stage in their development. As a partner, Nijhawan serves as a mentor and advisor to the founders of companies in the Cervin Ventures portfolio. He also helps to hunt for innovative start-ups and meets with entrepreneurs to pursue potential new investments.

Nijhawan has experience working in both large and small-scale company investment, but he’s found his passion in early-stage investing.

“I enjoy the formation stage when things are changing rapidly. I feel I can add the most value in those stages,” Nijhawan said. “I love what I do. I wake up every morning with a smile on my face, and I hope to be doing this for the rest of my life.”

Since its founding, Cervin Ventures has worked with 40 different technology start-ups, some of which have been sold to corporations like Intel, Oracle, NTT, PAR Technologies, Akamai, SmartBear, and more. Cervin Ventures currently has a portfolio of 30 active companies.

Investing in start-ups can be challenging and risky, since these companies don’t often have a fully working product, a strong customer base, or a stream of revenue. Nijhawan enjoys this challenge.

“When choosing which companies are worth investing in, we look for a great team with a great idea and a strong vision in a growing market,” Nijhawan said. “It’s an art form, not a science.”

The journey from founder to investor was not a short or easy one, but Nijhawan said he is motivated by being the best at what he does. He also credits the USC Viterbi School of Engineering for laying a foundation that set up his future pursuits and career.

Nijhawan enrolled in the master’s program at USC Viterbi in 1989, after receiving a bachelor’s degree in electrical engineering from the Birla Institute of Technology in Science in India, where he was born and raised. It was his acceptance into USC that led to him coming to live in the United States for the first time.

“USC changed everything for me. It was the reason I came to this country, and it gave me the foundation and platform to build what I have in the last 30 years,” Nijhawan said. “At USC, I got to meet bright, driven students from all over the world.”

A highly motivated student, Nijhawan completed his degree in just 15 months, earning a master’s degree in computer engineering in 1990.

After graduating, Nijhawan worked for six years as a program manager for Intel Corporation. He later pursued an MBA from the Massachusetts Institute of Technology.

After graduating from MIT in 1998, Nijhawan moved onto a different pursuit, one that would lay the foundation for the rest of his professional career. Nijhawan was part of the founding team of Akamai Technologies, a global content delivery network, cybersecurity, and cloud service company. Founded in 1998, Akamai remains one of the larger and most successful platforms in its space, and continues to operate a network of servers across the globe that gives customers faster and more reliable access to the Internet. Nijhawan left Akamai on good terms later that year to explore other pursuits.

In the decade that followed, Nijhawan held a variety of prestigious roles, from consulting associate at McKinsey & Company, to program manager at BMC Software, to vice president of NeoEdge Networks. With an impressive portfolio of experience and an extensive base of knowledge, Nijhawan had the foundation to pursue his interest in investing in start-ups.

The launch of Cervin Ventures in 2008 began, as Nijhawan describes, as an experimental pursuit. “I wanted to explore the possibility of getting into venture long term, so an old friend of mine, Neeraj Gupta, and I put together some of our own money and decided to see how we would do in early-stage investing,” said Nijhawan. “If we did well, we planned to go out and raise funds from other investors.”

They initially invested in four start-ups, all of which fared well. On the back of this success, they raised $21 million in 2011. Since then, they’ve raised two additional funds, with a total AUM of over $250 million. They’ve used the money to invest in more companies and continue to grow their portfolio.

“Preetish is not just my business partner at Cervin Ventures but a good friend who I have known for over 25 years,” said Gupta, who previously founded digital experience consulting firm, Nexient, and telecommunications consulting company, Cymbal. The pair met through a friend of Gupta’s who happened to be one of Nijhawan’s relatives. “While he is a successful entrepreneur and accomplished venture capitalist, his most important gift is his humanity and ability to connect with people in every interaction he has.”

Cervin’s portfolio is certainly impressive. A few companies that Nijhawan mentions as particularly exciting are Punchh, Catch&Release, AiFi, and Privacera. Punchh, which received a Cervin investment in 2013, works with restaurants to build customer loyalty using artificial intelligence and just sold to PAR Technologies for $500 million.

“Most restaurant chains that you go to have Punchh on the backend,” Nijhawan said. “This is a company I’ve been excited about from the beginning, and they’re doing really well.” The company uses data to help restaurants understand and build meaningful relationships with customers, and is currently used by franchises including Denny’s, TGI Friday’s, Taco Bell, Pizza Hut, and more.

AiFi is an artificial intelligence technology company with a vision to change the way we shop. The concept is that a customer can enter the store, pick out what they like, and leave without having to wait in a checkout line. All they need is an app, which communicates with an automation network that uses artificial intelligence and computer vision to charge their cards automatically once they leave the store. Nijhawan predicts this autonomous, “checkout-free” model is the future of retail. Cervin Ventures invested in AiFi in 2018.

“We’re on the cusp of a really exciting future,” Nijhawan said. “Technology has changed everything and it’s only the beginning. I find it very rewarding to get to be so involved in innovative companies that are going to continue to change the world.”

Published on June 9th, 2021

Last updated on June 9th, 2021