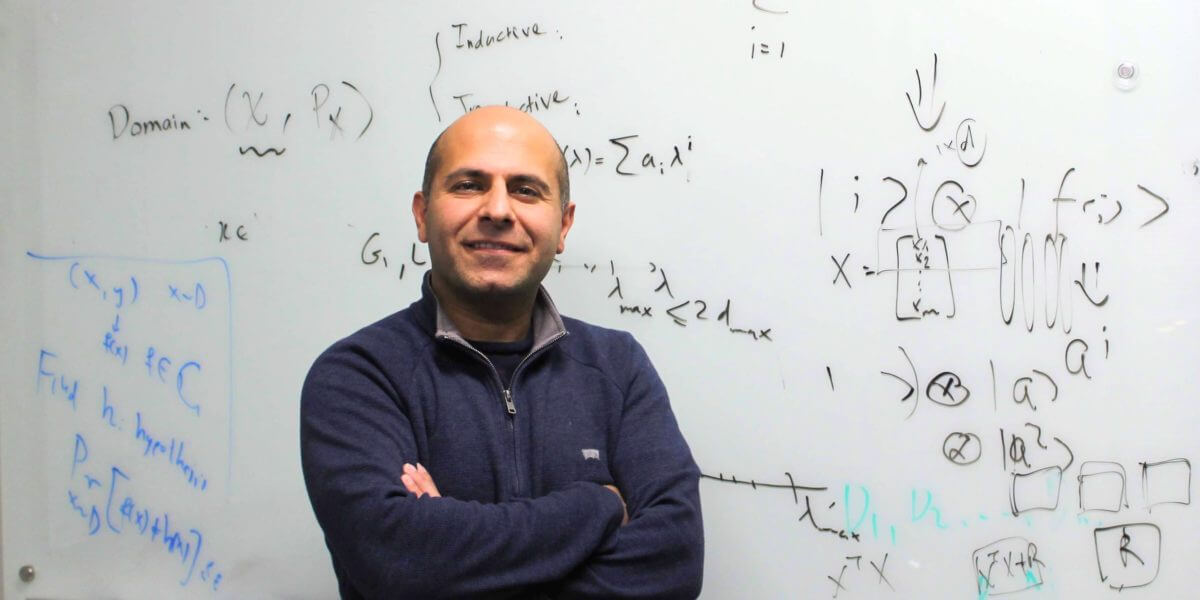

Salman Avestimehr helps create Unit-E a new, scalable digital currency. (PHOTO CREDIT: USC Viterbi)

Every strong relationship is based on trust. A marriage with no trust may lead to divorce. Loss of trust between allies could lead to conflict or war. When companies lose the trust of customers and employees, businesses fail. But there is one level of trust we rarely think about, even though it may have a bigger impact on our lives, our nations, and the world, than anything else: trust in money. When was the last time you looked at that paper with some past President’s face on it and stopped to think how amazing and mind-boggling it is that you can exchange that crumpled, dirty slip for almost anything? That is trust on a level most diplomats or CEOs can only dream of.

Professor Salman Avestimehr, a member of the Ming Hsieh Department of Electrical and Computer Engineering, has become intimately familiar with this level of trust. An expert in the areas of information theory, coding theory, and secure/private computing, his work has recently brought him into the world of crypto-currency. Together with researchers from six other universities, Avestimehr has helped create a new digital currency called Unit-e with the hope of finally succeeding in scaling up crypto-currency and helping the technology reach its full potential.

“We used to build trust based on our ‘tribe’ or where we came from. Today, much of that trust has been replaced by government, which is essentially trust in that government’s currency.”

“For crypto-currency to replace traditional payment methods it must do three things,” says Avestimehr. “It must be efficient enough to handle a lot of transactions, decentralized enough to maintain integrity, and secure enough to prevent fraud.” Current crypto-currencies are good at doing any two of these but it’s been impossible to achieve all three results. Bitcoin, for example, is decentralized and secure, but not efficient. In fact, the platform only allows for seven transactions per second. That’s not per person, or per company, that’s for the entire planet. Compare that to VISA, which can handle up to ten thousand transactions per second.

This leads to the specifics of Avestimehr’s work and the “beauty of coding,” as he puts it. Coding is a powerful tool in communication and storage. It’s what allows your computer to secure all of your files without having to duplicate each one. Until recently, no one knew how to use coding for computations; online financial transaction couldn’t benefit from the security that coding already provides to storage and communication.

Imagine you’re lost and come to a fork in the road with ten strangers standing there. You ask them all which way to go but there may be some bad actors who purposefully want you to fail. To feel confident in making a decision, you might want something like at least two correct answers for each person that gives you a wrong answer. That’s what doing computations without coding is like – slow and a huge drain of resources. Now imagine you show up at that same fork, but this time you have a lie detector with you. Not only don’t you have to get a majority people of people to answer correctly, you only need to ask one person in the first place! That’s what coding can do for computations.

The ultimate goal here is scalability. Avestimehr’s role in the team is to develop the algorithms, which will run the coding, for the purpose of making cryptocurrency secure, efficient, and decentralized. In other words, to make cryptocurrency trustworthy.

“The next stage of society could be what we are seeing with cryptocurrency and peer-to-peer systems.”

For all his technical expertise, Avestimehr can get downright philosophical when it comes to what this means for our future. Not a bad trait for engineers, who work on world-changing technologies every day, to have. “We used to build trust based on our ‘tribe’ or where we came from. Today, much of that trust has been replaced by government, which is essentially trust in that government’s currency,” he says. “The next stage of society could be what we are seeing with cryptocurrency and peer-to-peer systems.” What happens if national currencies are replaced with currencies tied to corporations? What does this mean for how we define ourselves, where our allegiances lie, or what values we build our societies upon? When trust shifts away from the institutions that govern us, the world changes and never looks back.

Published on February 28th, 2019

Last updated on February 28th, 2019