Photo/iStock.

California is known both for a cheery, idealized car culture and the grinding reality of traffic and sometimes dangerously polluted air. Undergirding those opposing images: 50,000 miles of aging roads, highways and freeways that continually must be maintained and repaired with gas-tax funding.

But low gas prices, accelerating fuel economy and public enthusiasm for electric and hybrid vehicle sales rapidly are driving gas-tax revenue down just as the state’s aging infrastructure demands major investment. A state legislature- led effort known as the California Road Charge Technical Advisory Committee (TAC) now is exploring gas-tax alternatives. Says Terry Benzel, a TAC member and deputy director of the USC Information Sciences Institute’s computer networks division, “This is really about helping the state chart a path forward in a very informed, thoughtful way.”

Road charges would involve assessing drivers for their actual road usage, not for gas consumption. The theory is that frequent drivers, whatever their vehicle efficiency, create more wear-and-tear on roads than occasional ones. Taxation experts also consider gas taxes are highly regressive, disproportionately impacting those least able to afford them. The lower people’s incomes, the farther from work they tend to live, and the older and less efficient their vehicles tend to be. Rural drivers can be especially hard-hit.

Terry Benzel

The road charge concept has gained urgency with the shift to all-electric and hybrid cars that use no, or far less gas than, their internal-combustion-engine counterparts. California, Oregon and Washington have launched road-charge pilot programs, and at least 20 other states are considering the concept.

In 2014, California Senate Bill 1077 mandated creation of both a road-charge pilot and the TAC to help define, oversee and assess the pilot’s results. Fifteen TAC Members — including legislators, public-policy specialists, city and county officials, corporate interests, and privacy advocates— designed the nine-month experiment, which wrapped up in March this year. TAC members, now examining results and formulating recommendations, are due to solicit public comments and report back by June 30, 2018.

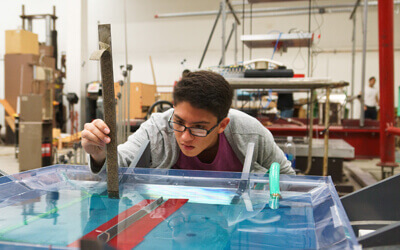

In the pilot, 5,000 drivers voluntarily deployed one of several different mileage-tracking methods, including a phone app and use of pre-installed telematics. The latter, which are programmed into some recent car models, include GPS data on location, speed and driving style. Not surprisingly, pilot volunteers tended to be young, male, tech-savvy and largely comfortable sharing driving data.

The same isn’t likely to be true of citizens at large. While road charges raise political and other issues, “the first layer down, it’s all about security and privacy,” says Benzel, also principal investigator for the DETER cybersecurity research and testbed project. Concerns include privacy about where individuals drove, when, how and in what vehicle, and the security of such sensitive, potentially exploitable data.

For instance, should insurance companies have access to individual drivers’ data, premiums potentially could be raised based on specific behaviors. Someone who drove to work every day via the same route, or his or her children, might be vulnerable to kidnapping or other crimes. And data might be used for purposes ranging from legal-but-irritating marketing campaigns to outright blackmail.

In the pilot, data was distilled and anonymized by a third- party firm that provided generalized results. Still, major companies like Target, Home Depot and Anthem, along with high-profile government targets, have lost massive amounts of individual data. The fundamental security issues are actually “fairly standard,” Benzel says: “What’s the confidence we have that this data won’t get hacked?”

Data sensitivity also is linked to how that information is used, shared and stored. For example, while Californians might not object to tracking of the miles per week they drive, they may be highly sensitive to information being stored on where they go. “We need to contextualize the data,” Benzel says. That includes drawing clear boundaries around how data crunchers could sell or use data in new offerings. Says Benzel, “The business model between the state and third parties will need to be scrutinized.”

Under SB 1077, preliminary TAC recommendations must include non-tracking — that is, only total miles driven — and tracking options with location-specific detail. Possibilities include odometer readings, physical dongles attached to cars, smartphone apps and telemetric data, each with unique security challenges. Payment methods might include paying at the pump or charging station before fueling up (an issue for cars charged at home), as part of state income taxes or alongside smog checks.

All this may come as a surprise to Californians in the wake of a 12-cent-per-gallon gas tax increase passed in April this year. But the TAC considers the tax to be a stopgap measure, says Benzel. And any road charge implementation likely would take many years. Sacramento still would need to craft rollout strategies and determine whether the gas tax would be augmented or gradually sunset.

Given the pilot’s demographics, the final TAC report just might include a recommendation in the best government- study tradition: to undertake another pilot, this time with a more diverse road-warrior mix.

Published on July 7th, 2017

Last updated on June 3rd, 2021