Photo Credit: NanoStockk/iStock

Why is it valuable to understand financial statements when wanting to invest in savings? How does understanding financial information keep one from making risky money choices?

Reading and understanding financial statements can be an intimidating task, especially for those who lack a financial background. Particularly, the dense numerical data and mix of complex financial terminology are only some of the things that make it hard to comprehend.

In a society where finances play a central role in everyday activities, having a financial education can serve as an important tool for businesses and investors to make informed decisions.

What if there was an easier way to alleviate the burden of misunderstanding financial data?

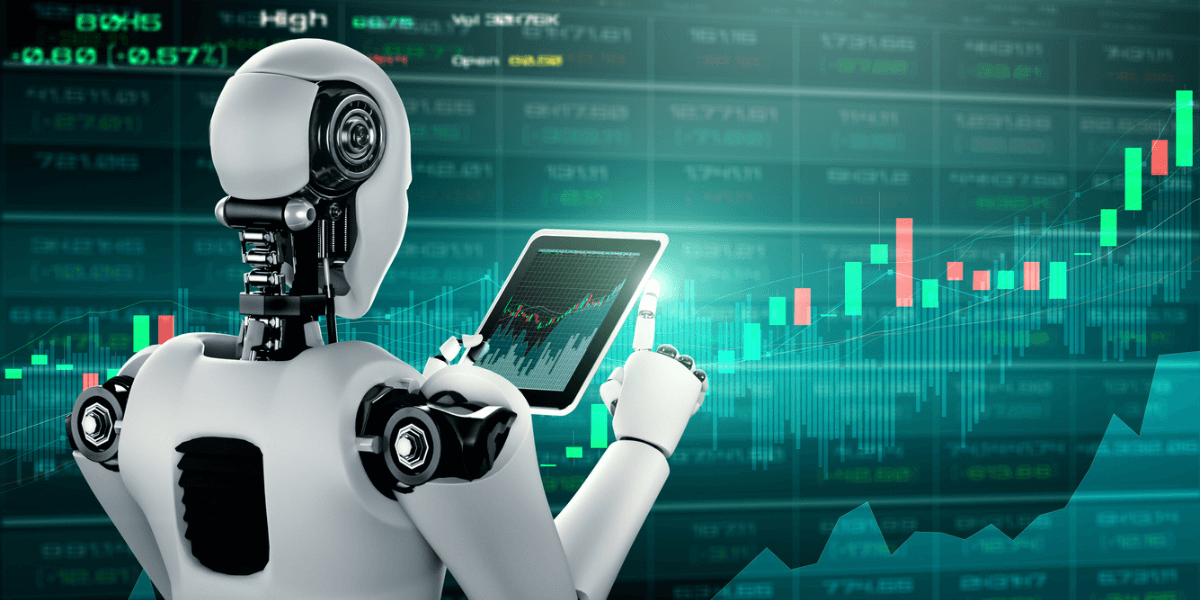

The answer lies within case-based reasoning (CBR) – A problem-solving approach in artificial intelligence (AI) that works by learning from past experiences to solve new problems.

“The key question we wanted to address is how artificial intelligence can enhance its learning from humans and establish a collaborative environment,” said Pujara, research lead.

This is an important tool for society as it allows us to analyze past cases from previous financial situations to make better decisions in the future. Companies and investors have their eyes set on overall financial growth and stability – Which CBR can aid.

A group of researchers led by USC’s Information Sciences Institute Jay Pujara and Kexuan Sun applies case-based reasoning to seek a more efficient and accessible way to answer financial questions and help companies make more informed decisions.

“You hear stories emerging about companies misusing funds during the pandemic. Our goal is to ensure resources go where they do the best by applying automated financial investigations.”

How Can AI Help with Financial QA?

Often, the biggest questions that come up to companies when dealing with financial information are related to understanding the financial health of a company or organization – Is the company profitable? How does the company compare to its competitors?

Companies highly value time as it plays a significant role in financial planning and decision-making.

By using its capabilities to analyze data at a fast speed, AI is able to recognize trends and patterns that allow other companies to make better decisions when it comes to investments.

“Around 15 years ago, we experienced a financial crisis where the economy entered a recession. Can you imagine a scenario where these automated systems could have the capabilities to detect and prevent such situations in advance?”

AI can also further enhance comprehension by the use of its natural language processing that analyzes text to provide context from a dense data table.

Pujara said, “We wanted to foster a collaboration that doesn’t require significant effort. It’s an approach where humans foster their own strengths, and AI is there to learn from these contributions and offer assistance if needed.”

How Case-Based Reasoning is Used

In order to address the difficulties of interpreting financial information, researchers use case-based reasoning. It is done in a multi-step process that involves case selection, fact retrieval, and program generation.

Imagine a scenario where a student needs to complete a math worksheet.

Pujara added, “Our system is designed to recall what is learned during class – the teacher’s explanations and steps to accomplish a math problem. Then, it applies the same approach to complete the worksheet. This is the same concept with case-based reasoning.”

Case selection allows the researchers to find similar questions relevant to finances in the past to help with the solution.

Fact retrieval then gathers data to make sure it is accurate.

Program generation ultimately creates a formula using the information collected to accomplish the task.

“There are challenges that still arise. Whether it’s gathering factual information or computing the right program, the complexity is intriguing.”

RobustFin 2023

The Low-Resource Financial QA with Case-based Reasoning is being presented first in Robust NLP for Finance (RobustFin). This workshop explores the study of technologies that aid financial language processing.

This paper is set to be presented on August 7th, 2023.

Published on August 17th, 2023

Last updated on August 17th, 2023